We woke up to yet another bank acquisition UBS buying rival Credit Suisse. Is this a red flag spurred by SBV collapse? Is this a copycat of the 2008 stock market crush due to global banking crisis? This and much more below and most important; What does it mean to you as a Canadian consumer?

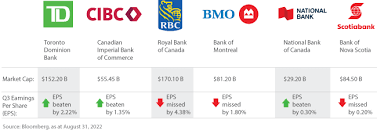

Deep in the footnotes, CIBC reported that $52-billion worth of mortgages – the equivalent of 20% of the bank’s $263-billion residential loan portfolio were in a position where the borrower’s monthly payment was not high enough to cover the interest portion of the loans. The bank has allowed these borrowers to stretch out the length of time it takes to pay off the loan, which is known as the amortization period. Higher interest rates are finally starting to bite. First, Canadian Banks reported Q1 earnings

What banks do to protect their interests ? a. allowing unpaid interest at the end of the mortgage term b. extend the amortization rate (extend and pretend everything is going to okay, but is it?) b. As well, borrowers are adding unpaid interest onto their original loan or principal. The goal for the banks is to keep consumers forever in debt.

The proportion of mortgages with amortization periods longer than 30 years: BMO: 32.4%, CIBC: 30%, TD: 29.3%, RBC: 25%

This is what media is NOT talking about; debt gets repriced, so too does the asset. A lot of mortgages have or soon will suddenly be morphed into interest only mortgages when the Bank of Canada set off a wave of trigger rates. Banks are allowing borrowers to kick the can because your house is the banks collateral and they don’t need your house hitting the MLS in a forced liquidation.

If you’re wondering why there hasn’t been a wave of distressed sellers you can thank the Canadian banks? They are actively protecting their own loan books by sheltering Canadian households from the full brunt of interest rates. The value of all Canadian Real Estate is over $300 Trillion. And there is a lot of debt underpinning the value of that Real Estate.

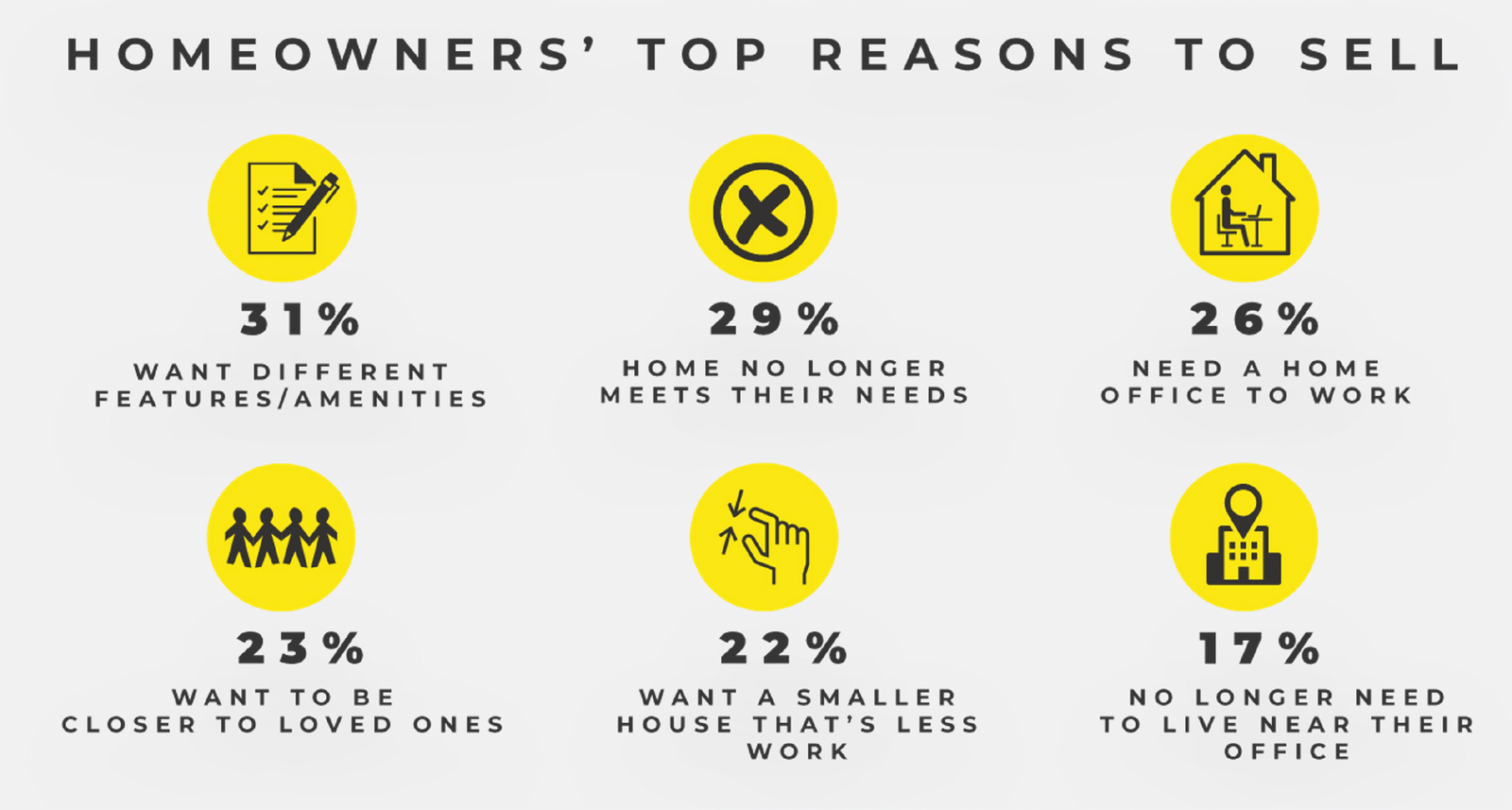

The current property market conditions in Vancouver, BC, are characterized by a combination of rising prices, declining supply, and strong demand. Advice to clients is always not to worry too much about what the market is doing if buying for for where you are living. We need shelter so with cost of living high why not invest in your wealth ? Here are top reasons to sell;

So, what does this all mean to me ?

The current property market conditions in Vancouver, BC, are characterized by a combination of rising prices, declining supply, and strong demand. Advice to clients is always not to worry too much about what the market is doing if buying for for where you are living. We need shelter so with cost of living high why not invest in your wealth ? Here are top reasons to sell;

So, what are your reasons for moving? Comment below if you are a seller and do not know what to do with this market adjusting please contact me for a free consultation. It is essential to stay informed and seek professional advice if on the fence before making any important decisions.

One of the main drivers of the current market conditions is the high demand for housing. This demand is being driven by several factors, including a growing population, interest rates, and a strong local economy. Additionally, many buyers are attracted to Vancouver due to its high quality of life, diverse culture, and beautiful natural surroundings. They do not make land anymore.

In conclusion, the outlook 5-10 years for the Vancouver property market, although can be considered uncertain in the short term, it’s all POSITIVE. If you have owned a property for more than 5 years Home Price Index always shows profit.