Summary;

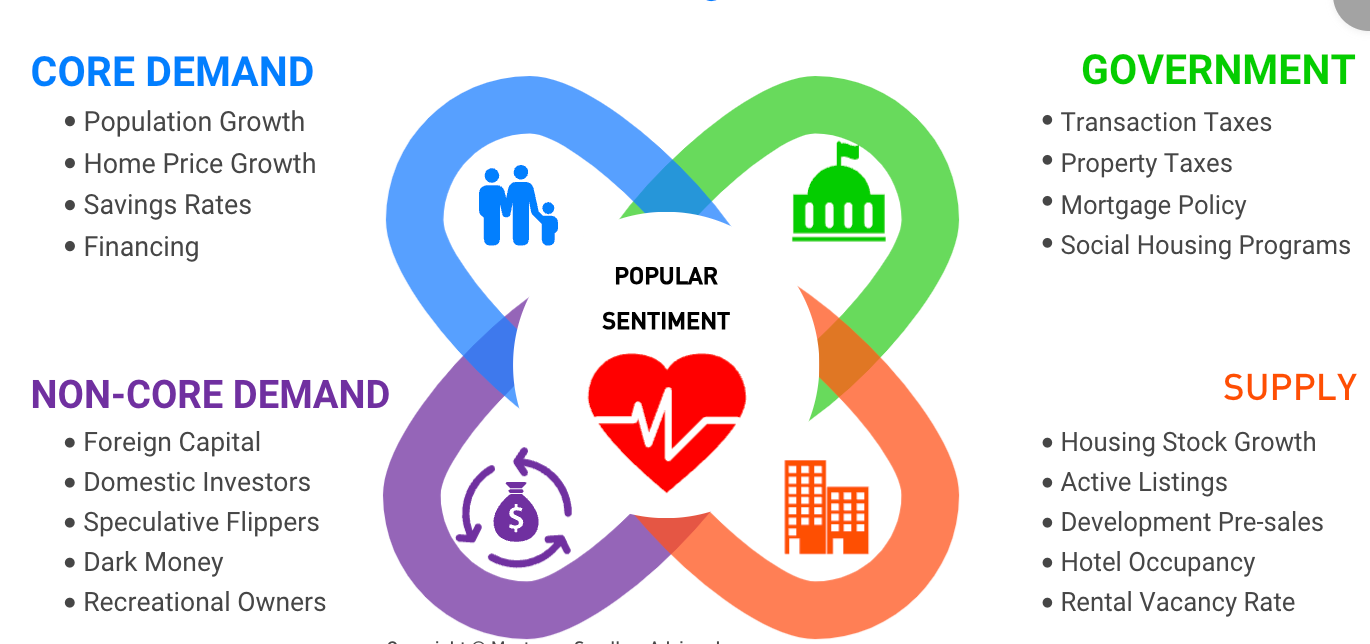

In the past two years, we've seen a dramatic shift in the economic landscape. Inflation has largely been brought under control, but new challenges are emerging: labour market pressures, rising debt burdens, and a wave of new housing policies from all levels of government. Understanding the shifting factors is key to making informed decisions about buying, selling, or investing.

WHAT ONCE WAS LOST BUT NOW IS (PARTIALLY) FOUND

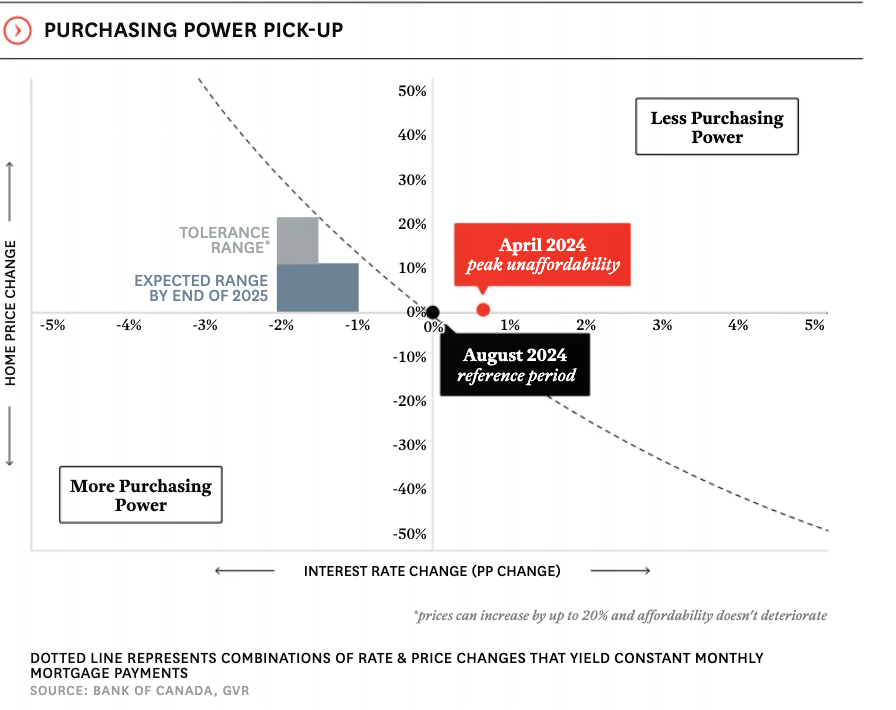

In today’s environment of declining interest rates, homebuyers are starting to regain some of the affordability they lost to higher rates. Looking ahead, further affordability gains are likely as the Bank of Canada continues to steer towards a “neutral policy rate.” Should the Bank's policy rate settle around 2.75%, it will contribute to improved affordability.

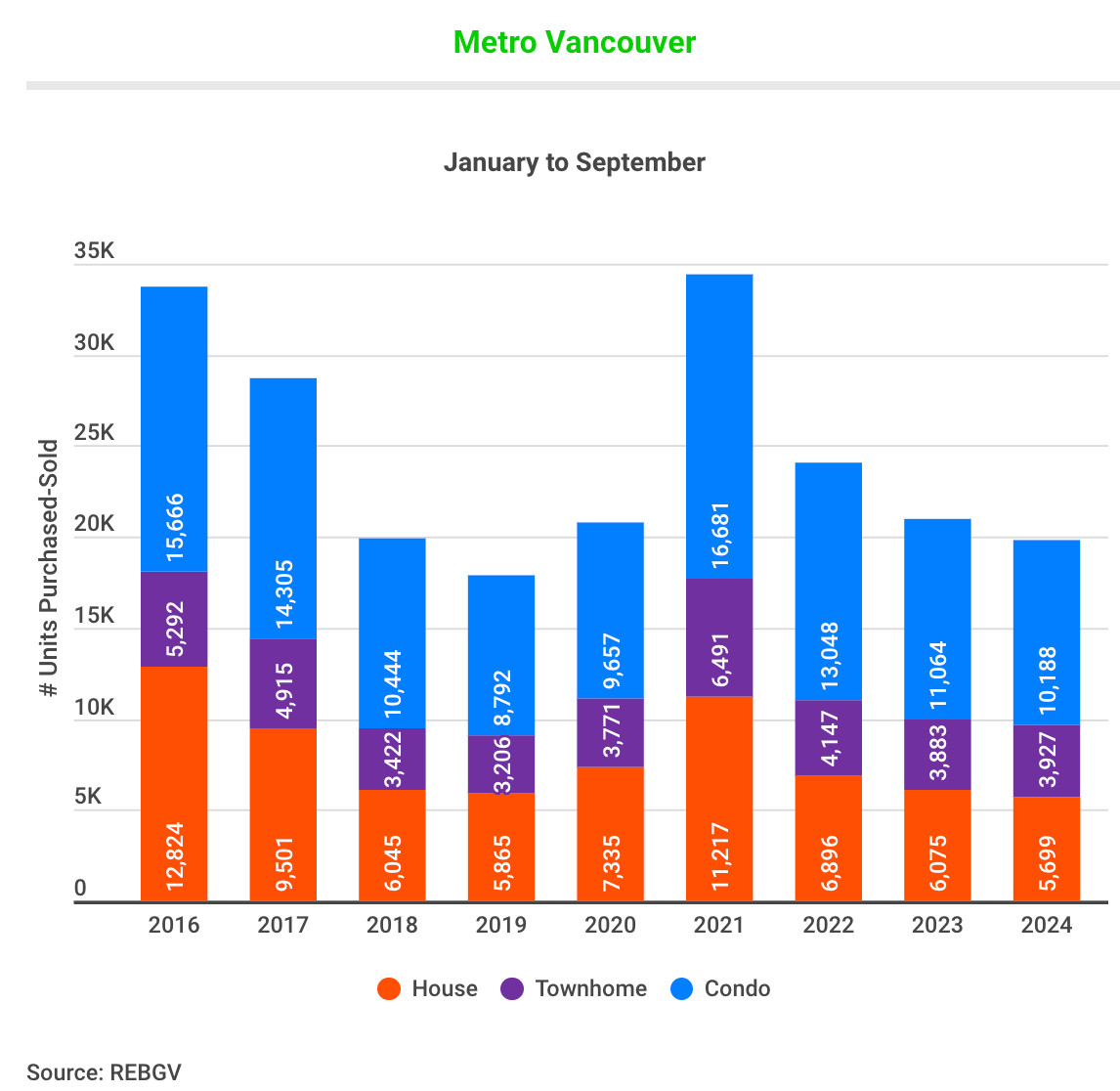

This is especially beneficial for those who have been able to save disposable after-tax income or build equity in their current home. Additionally, the narrowing price gap is making it easier for condo owners to move up the property ladder, see chart

This is especially beneficial for those who have been able to save disposable after-tax income or build equity in their current home. Additionally, the narrowing price gap is making it easier for condo owners to move up the property ladder, see chart

GROWTH BY ANY OTHER NAME…

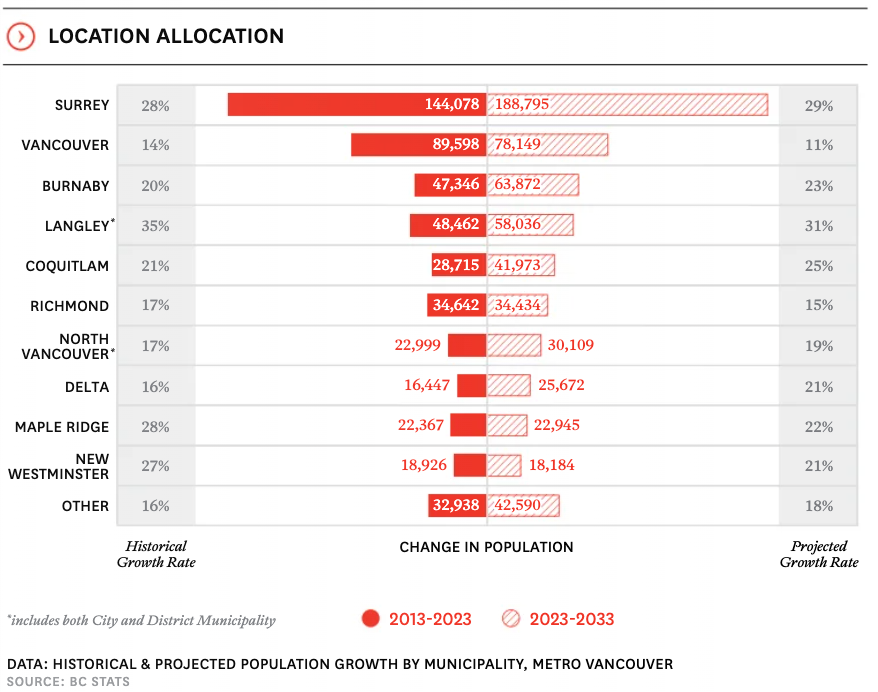

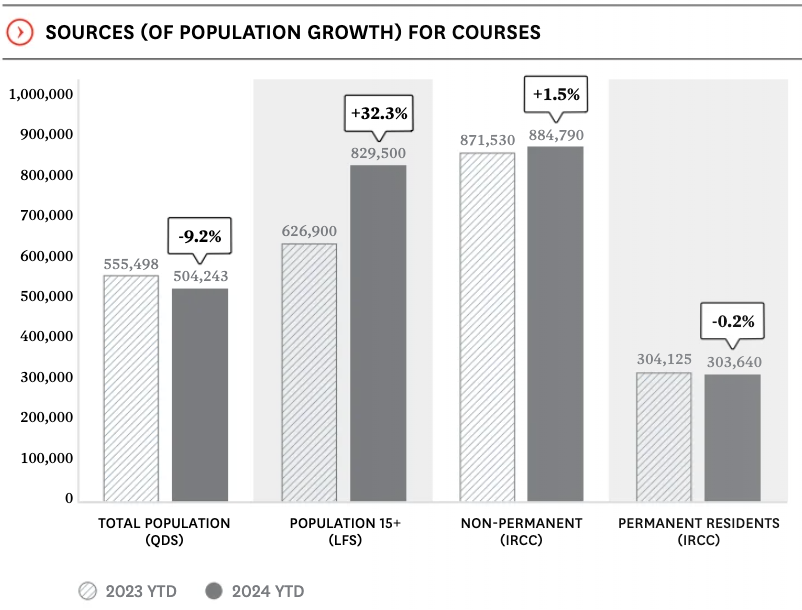

After two years of unprecedented population growth, the federal government has pledged to slow the pace of in-migration. However, any future growth in BC will still require significant increases in housing construction, alongside expanded transportation and infrastructure, to meet the rising demand especially in these areas of GV.

TIME IS OF THE ESSENCE

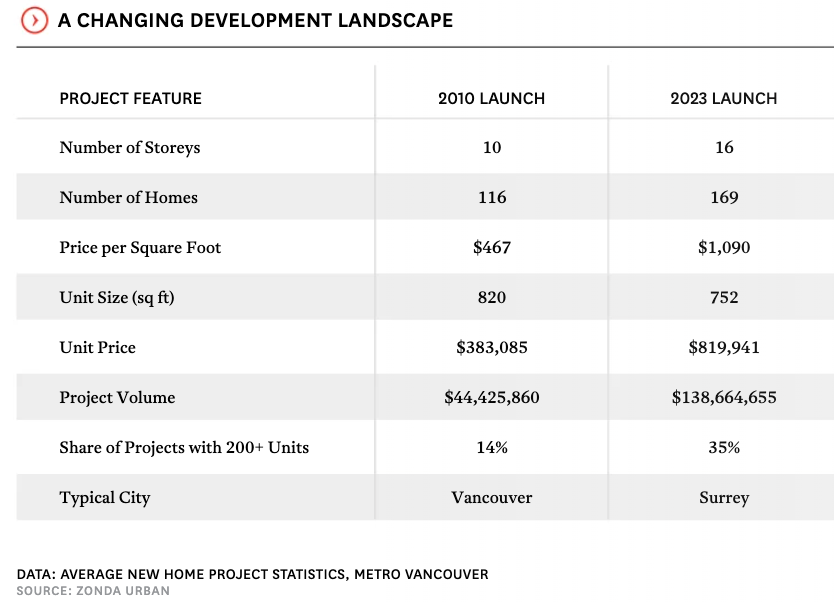

A contributing factor to the current housing shortage is the slowdown in pre-sale activity, as new home developments in Metro Vancouver grow in scale and complexity. These larger projects take longer to sell, finance, and complete, which means timelines are extended and supply remains tight. See unit price 2010 vs 2023 and location being mostly build.

CAPITALIZING ON INVESTORS: POLICY CHANGES AFOOT

In April this year, the federal government announced changes to the capital gains inclusion rate, which had previously been set at 50%. Under the new rules, effective June 18th, businesses now face a 67% inclusion rate on capital gains, and individuals will pay the higher 67% rate on capital gains exceeding $250,000.

These changes, combined with other policies targeting investors, have dampened demand in the market. Given the crucial role investors play in adding new housing stock through pre-sale purchases, these policy shifts will likely have a negative impact on new housing supply.

These changes, combined with other policies targeting investors, have dampened demand in the market. Given the crucial role investors play in adding new housing stock through pre-sale purchases, these policy shifts will likely have a negative impact on new housing supply.

What should I do?

Transparent and honest guidance is critical to making the best home investment decisions - in particular the recognition of the always present risk of home prices dropping in the future if the right combination of forces and factors causing this emerge. Above all you should view the home you live in as a place of shelter and comfort for you and your family rather than a quick and easy way to make a buck or two.

Should Homeowners Sell ? If you plan to sell within 1-2 years, or your retirement savings are tied up in real estate, then you may want to make a move sooner then later. Your micro-local market may be insulated from a housing correction but speak with your real estate advisor on specifics.

Is it a Good Time to Buy? It can take two or more years for real estate values to hit bottom and mortgage rates are expected to be even lower in 2025. If your family is growing, then go ahead and buy, but be sure to drive a hard bargain.

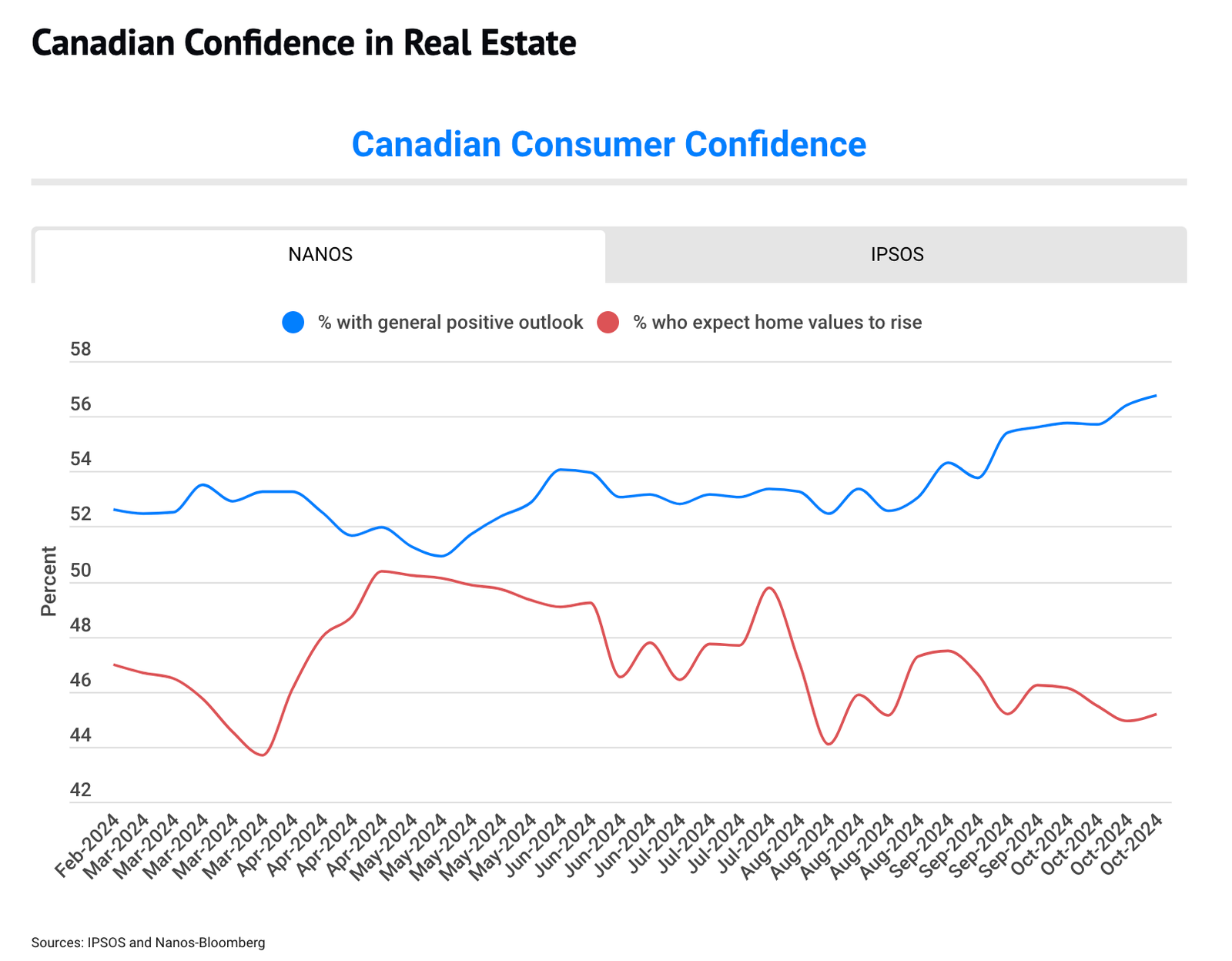

Whether you buy or sell always make sure seek guidance from a professional realtor who will enable you to get the best possible market value that you deserve. The overall confidence in real estate is high and the popular sentiment could exceed any economic indicators.

Please don’t hesitate to contact me by email or by phone/text if you would like me to provide you with insights of your particular market and situation. See this blog in video version