It seems like people are always waiting for something. Whether it’s waiting for elections to be over, interest rates to drop, or prices to fall, the cycle continues. Many only act when they see others in their sphere of influence—friends, family, or the media—acting, or when they’re told that the market is going down. While doing your own research is smart, the data you find can often be taken out of context and may not be as reliable as it seems. So, let’s dive into the real questions everyone seems to have:

It seems like people are always waiting for something. Whether it’s waiting for elections to be over, interest rates to drop, or prices to fall, the cycle continues. Many only act when they see others in their sphere of influence—friends, family, or the media—acting, or when they’re told that the market is going down. While doing your own research is smart, the data you find can often be taken out of context and may not be as reliable as it seems. So, let’s dive into the real questions everyone seems to have:1. What are the current Greater Vancouver real estate trends?

2. What’s the real cost of waiting?

3. Why am I moving, and how will this move benefit my lifestyle both now and in the long term?

Sure, I’m a realtor, so you might think I’m a little biased—but hey, take this with a grain of salt and consider the bigger picture.

____________________________________________________________________________________________________________________________________________

1. The Real Estate Trends: A Snapshot

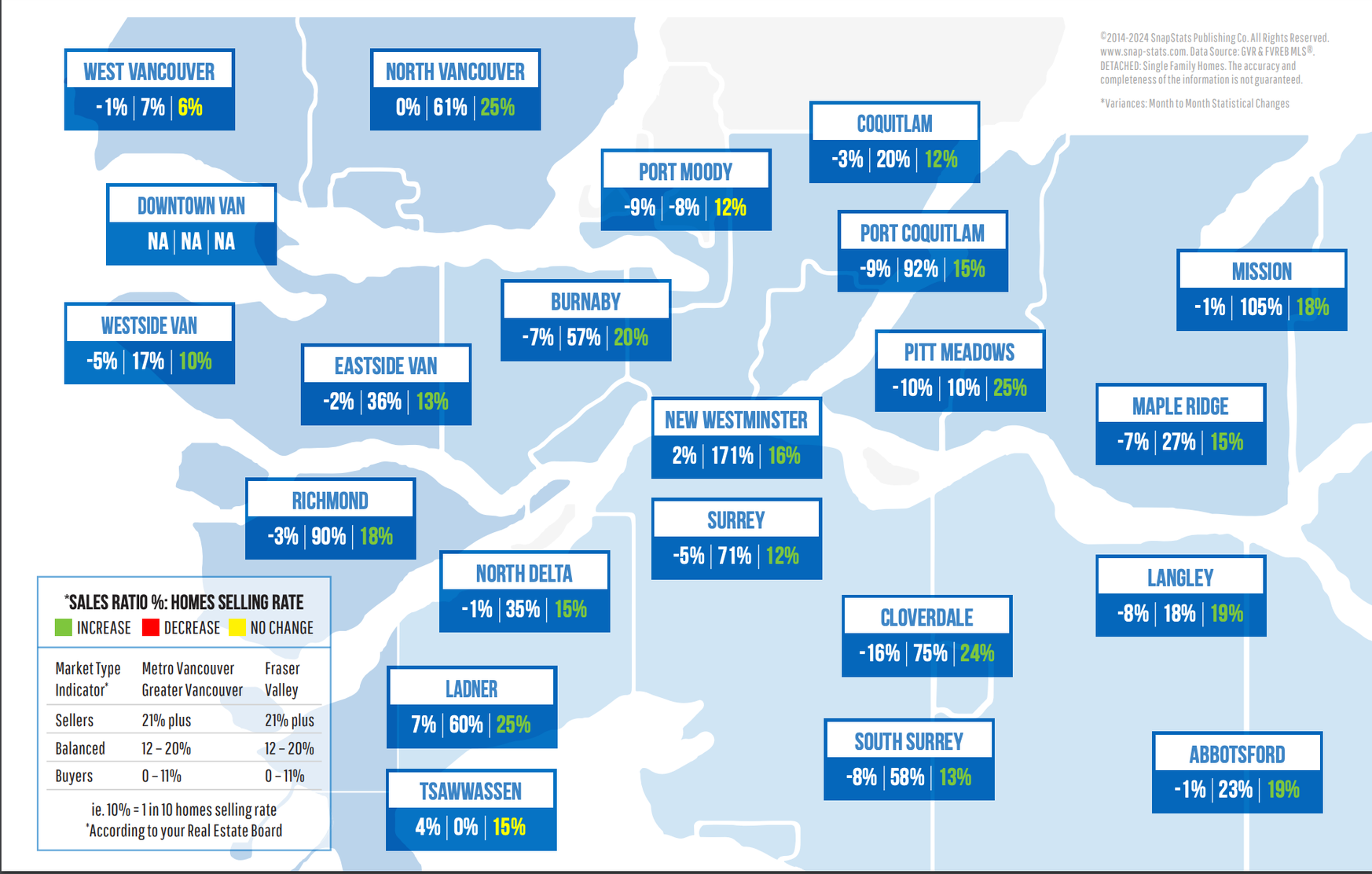

Many people want to know what’s happening right now in the market. They want exact figures and trends—whether it’s the average sale price, days on market, or sale-to-list ratios. But here’s the thing: trying to time the real estate market is tough.

You might be obsessing over stats like how long a property has been on the market or the price per square foot, but the truth is: If you need to move—whether it’s for a growing family, a new job, or just to reduce your daily commute—those things may not matter as much. Even with all the data in hand, the reality is that once you find the right property, chances are someone else is looking at it too, and you might end up in a multiple offer situation—which, let’s face it, is what you were trying to avoid in the first place.

____________________________________________________________________________________________________________________________________________

2. The Cost of Waiting for the “Big Shift”

Now, let’s talk about the real cost of waiting for that next big market shift. The reality is: if you’re waiting for the perfect moment, you might find yourself sidelined. Timing the market in Vancouver real estate can be tricky, and it’s not always worth the wait. Here's an example to put it into perspective:

Example: Average Vancouver Home ($1.6M)

• Yearly Market Cycles: +/- 5-7% = $100K

Real estate markets tend to follow cycles, so waiting could mean missing out on potential appreciation.

• Seasonal Factors: +2-3% = $50K

The market is often more active in spring and fall, meaning more opportunities to buy or sell.

• Interest Rates: @ 5.5% = $50K

If interest rates are higher, you could be paying more on a mortgage.

• Supply and Demand: Limited supply + high demand = + $100K

When supply is low and demand is high, prices tend to go up. This impacts both buyers and sellers.

• Personal Goals and Financial Situation: Capital gains = $ 40K

Whether you’re buying for long-term growth, rental income, or short-term profit, your financial situation matters.

• Risk Tolerance: Hard to quantify; Risk tolerance plays a big role in the decision-making process.

Total Cost of Waiting: $250K less

While the market fluctuates, waiting might result in missing out on that potential gain.

Cost of Buying Now: $250K more

If you wait, you could end up spending more when you finally decide to make a move.

Timing the Market Could Cost You: $500K

Waiting for that perfect moment could end up costing you in ways you didn’t expect—losing out on equity, missing opportunities, or simply paying more in the long run.

____________________________________________________________________________________________________________________________________________

3. Why Am I Moving and How Will It Benefit My Lifestyle?

3. Why Am I Moving and How Will It Benefit My Lifestyle?

This is the most personal part of the decision-making process. People move for all sorts of reasons—closer to family, better schools for the kids, proximity to work, or simply a new change of scenery. Some move for lifestyle, some for financial reasons, and others because their circumstances change.

One of the biggest questions many people face is whether to sell their current home before they buy the new one, or vice versa. The answer depends on your personal goals, market conditions, and what works best for your unique situation.

Buy First Sell First

More competition Less competition

May need a temporary place to stay Immediate cash from sale

You might miss out on a perfect home Less financial stress

You risk paying higher mortgage rates More flexibility in negotiation

In Conclusion:

More competition Less competition

May need a temporary place to stay Immediate cash from sale

You might miss out on a perfect home Less financial stress

You risk paying higher mortgage rates More flexibility in negotiation

In Conclusion:

While it’s easy to get caught up in the day-to-day market fluctuations, remember that real estate is a long-term game. Timing it perfectly is almost impossible, and sometimes it’s better to focus on your personal needs and goals rather than waiting for the "next big shift." So, ask yourself: What is your timeline? What is your lifestyle worth to you right now? Is waiting worth the risk, or would making a move now better serve you in the long run?

At the end of the day, it’s about finding the right fit for your life, not just your bank account. Whatever your decision, make sure it aligns with your needs and aspirations.